Financial institutions can utilize AI to automate tasks, reduce risks, and boost efficiency. AI is particularly beneficial in adhering to regulations while simultaneously improving customer service.

However, to effectively utilize AI technology it’s crucial to gain an understanding of its inner workings. This feature will explore AI technologies that are revolutionizing the financial industry.

Artificial Intelligence

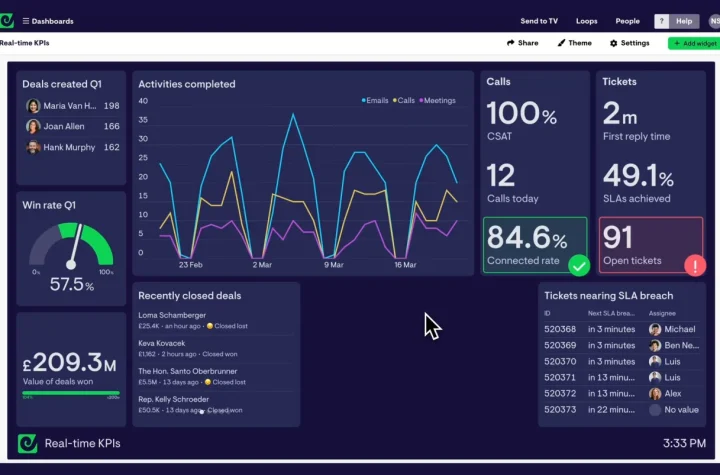

Artificial intelligence technology enables financial services firms to automate and streamline their operations while cutting costs, increasing efficiency and improving customer experience. AI also offers improved data analytics capabilities as well as faster insights for responding and anticipating, enhanced security measures, better risk management capabilities and much more.

Implementing new technology at banks or insurance companies carries risks that must be carefully managed in order to strike an ideal balance between humans and machines. An error caused by AI systems could have devastating repercussions for a quote, communication or processing customer files.

Financial industry stakeholders are turning to Gen AI technology in order to reduce manual errors, enhance data analysis and performance measurement, increase accuracy in risk assessments and credit scoring, streamline operations and reduce cost, deliver superior customer service and investment decision-making, drive innovation and foster culture change while meeting younger consumer needs. Intel is committed to making sure our hardware and software solutions remain secure during financial institutions’ journey into Gen AI technology; our Intel SGX platform helps protect data using hardware-based confidentiality enclaves while our developer resources help accelerate deployment while optimizing performance.

Machine Learning

Machine learning is becoming an increasingly common tool in financial services. It can streamline programs and procedures, automate routine tasks and enhance customer experiences – as well as offering cost savings of $70 billion by 2025 according to Business Insider!

Machine learning technology has many applications in the financial industry, from robo-advice and loan eligibility assessment, credit scoring and fraud prevention to investment trading. Machine learning helps save financial institutions time on manual processes while eliminating human biases caused by psychological or emotional factors.

Machine learning technology can assist financial firms in complying with regulations and identifying issues missed by humans, but as with any tool it must be used with care and caution. As well as making sure their AI systems are accurate and up-to-date, companies should ensure their AI systems can explain why decisions were made so that clients understand why decisions were reached.

Natural Language Processing

Financial services firms are taking advantage of AI to streamline back office operations, expedite document processing and onboarding processes and increase customer engagement. From verifying or summarizing documents to transcribing phone calls or summarizing regulatory reports – even providing answers to common customer queries such as “What time do you close?” AI can complete these tasks faster and more accurately than humans can.

Banks are turning to AI chatbots as an economical solution for providing round-the-clock customer service at an unrivalled speed and quality. Capable of answering simple inquiries quickly while seamlessly handing off complex issues to a representative when necessary, banks are turning AI chatbots into 24/7 customer service assistants at significantly reduced costs.

Though AI may eliminate jobs in some sectors, financial industries will still need people to develop and implement AI tools. He noted the importance of understanding this emerging technology to stay ahead of its implementation; this involves making sure AI models can be explained and traced, validating outputs to prevent hallucinations or bias and providing insights for improvement.

Deep Learning

AI can assist financial institutions in automating tasks, reducing costs and increasing operational efficiency. AI also can assist with fraud detection and cybersecurity measures according to Forbes; for example it could analyze an individual’s digital footprint to make more accurate credit decisions; it can detect patterns in behavior which may indicate fraudulent activity that alert both the institution and customer so transactions can be verified before proceeding further.

Technology can also facilitate loan applications more smoothly, provide personalized customer service through data analytics and enhance overall user experience with robo-advisors, chatbots and personal assistants that offer tailored recommendations and answer queries 24/7.

Generative AI — which learns over time using user input and data analysis — holds great promise to deliver accurate predictions and enhance customer experiences. However, its use should be implemented carefully within an established legal framework.

More Stories

DeFi and Web3 Personal Finance for Cautious Beginners

Managing Finances for Blended Families and Modern Non-Traditional Households

Wealth Building Strategies for Solopreneurs and Freelance Professionals